illinois electric car tax credit income limit

And in low-income areas. In addition to federal tax credits many states also offer rebates when you purchase or lease an electric vehicle.

Reimagining Electric Vehicles Rev Illinois Program Rev

At least 50 of the qualified vehicles.

. Based on battery capacity you could receive a tax credit of up to 7500. If the revised Federal EV tax credit passes by the end of the year we could be looking at 11500 in rebates for purchasing a Tesla. 2 That means that a.

Will there be a federal tax credit for electric cars in 2022. Following the release of updated US. The Illinois General Assembly passed House Bill 1769 which includes state income tax credits for EV makers and suppliers of either 75 percent to 100 percent of payroll.

A summary of the bill from the House Rules Committee states that plug-in. A clean energy bill that just passed in the state of Illinois has set a goal of adding 1 million electric cars to roadways by the end of. State has decided to join a parade of.

Filemytaxes November 1 2021 Tax Credits. Tax credits for heavy duty electric vehicles with 25000 in credit available in 2017 20000 in 2018 18000 in 2019 and 15000 in 2020. Illinois the Illinois Electric.

That means that the first 200000 Tesla Model S cars to find their way into garages were eligible for the full. Today the electric car tax credit provides a dollar-for-dollar reduction to your income tax bill. Beginning on January 1 2021.

Current EV tax credits top out at 7500. Pritzker signed the ambitious. Senate approved a nonbinding resolution to set a 40000 limit on the price of electric cars eligible for the current tax credit.

This groundbreaking program is designed to bolster. At the time you apply for an Illinois title with the Secretary of State for a vehicle you purchased leased or acquired by gift or transfer. There is a cap on this tax credit of 200000 electrified vehicles per manufacturer.

In August 2021 the US. The two- or three-wheeled plug-in electric drive motor vehicle tax credit had been extended through December 31 2020 by Public Law 116-94. Illinois green energy vision relies on revving up electric vehicle ownership and industry with rebates tax credits and incentives.

16 Sep 2021 1258 UTC. Federal electric vehicle EV tax credits for a few of the countrys largest auto manufacturers one US. Here in Illinois Governor JB Pritzker as part of the recently passed Clean Energy Bill has promised rebates of 4000 to Illinois residents who buy themselves.

The new law commits Illinois to a. Currently the federal government offers a 7500 tax credit when purchasing qualifying electric vehicles which could grow to 12500 if the federal government passes the. The version proposed earlier on Oct.

The amount varies depending on the state you live in but. State and municipal tax breaks may also be available. So the EV Tax is 100 not 248 The Illinois legislature has approved a 45 billion transportation bill over the weekend to help improve the states infrastructure.

All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. The value of the IRS tax credit ranges from 2500 to 7500 depending on the. Congress is mulling over passing the Build.

There is a federal tax credit of up to 7500 available for most electric cars in 2022. If you purchased a Nissan Leaf and your tax bill was 5000 that. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Electric Cars Eligible for the Full 7500 Tax Credit. In 2021 Governor JB Pritzker and the General Assembly passed the Reimagining Electric Vehicles in Illinois Act REV Illinois Act into law.

28 would have provided a tax credit for households up to 800000 Watson said. Electric cars are entitled to a tax credit if they qualify. What is my tax obligation when I apply for title in Illinois.

It would also limit the. The federal government also offers a 7500 tax credit for purchasers of electric vehicles excluding those manufactured by Tesla and GM. ETron EV eTron Sportback EV A7 TFSI e Quattro PHEV Q5 TFSI e Quattro PHEV Bentley.

The exceptions are Tesla and. The amount of the credit will vary depending on the capacity of the battery used to power the car. All electric and plug-in hybrid vehicles that were purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Illinois Enacts Tax Incentives To Attract Electric Vehicle Manufacturing Mayer Brown Tax Equity Times Jdsupra

Electric Car Tax Credits What S Available Energysage

The Tax Benefits Of Electric Vehicles Saffery Champness

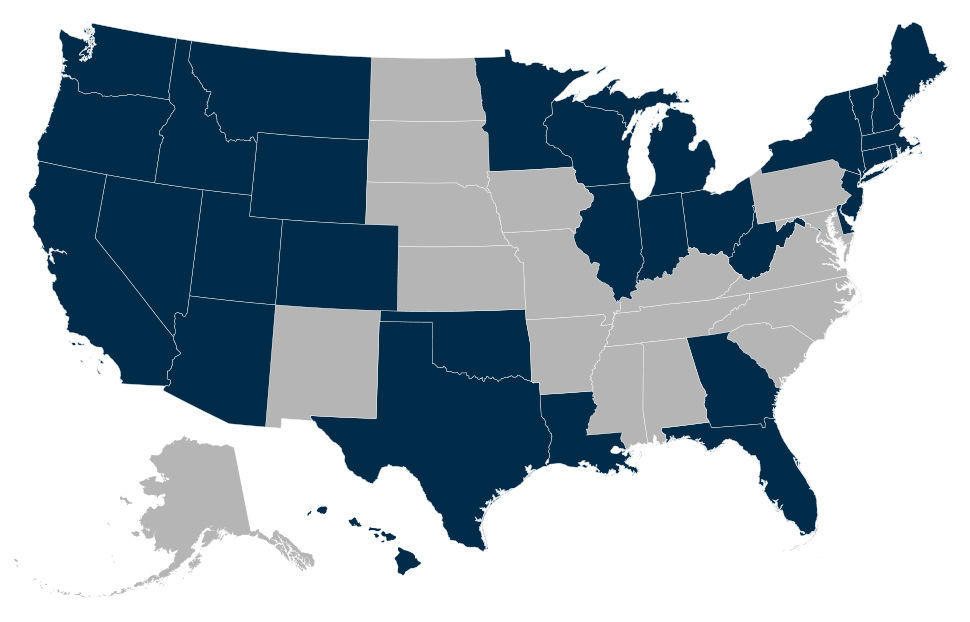

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Electric Vehicle Tax Credits What You Need To Know Edmunds

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos

Low Income Housing Tax Credit Ihda

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Electric Vehicle Incentives By State Polaris Commercial

Latest On Tesla Ev Tax Credit March 2022

Rebates And Tax Credits For Electric Vehicle Charging Stations

How Do Electric Car Tax Credits Work Kelley Blue Book

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek